This is the sixth episode of the real estate holding structure series. In this series I walk you through the thought process of a non-resident who wants to buy a home in the United States for personal or family use–not for rental.

- Episode 1 – Thirteen single-level holding structures exist for possible use. (We’ll deal with multi-level holding structures later. Three are eliminated: forbidden, logically impossible, or wildly impractical.

- Episode 2 – Of the ten remaining single-level holding structures, we eliminate three because they are guaranteed to result in estate tax if the real estate owner dies.

- Episode 3 – Of the remaining seven holding structures, four have uncertain estate tax results. Some are more uncertain than others. Eliminate them: “maybe” means “no.”

- Episode 4 – Of all of the single level structures we considered, three remain. All of them are guaranteed to provide estate tax protection.

- Episode 5 – We started looking at more complicated holding structures. We identified the two-tier holding structures to use, and then took a deep dive to look at how we can add estate tax protection by making a foreign corporation the sole member of a domestic disregarded intently instead of a nonresident individual.

- [You are here] Episode 6 – This episode looks at adding a foreign corporations to other single-level holding structures: how it works, why it works, and pitfalls to avoid.

Overview

Only three types of single-level holding structures will protect a nonresident’s U.S. real estate investment from U.S. estate tax. The title-holding entity must be a:

- foreign corporation,

- domestic nongrantor trust, or

- foreign nongrantor trust.

Trusts will be discussed in the next episode. Here, I show how single-tier holding structures – with estate tax exposure for the investor – can be fixed to provide estate tax protection by adding a foreign corporation.

Principles

The Gross Estate

U.S. estate tax is imposed on a nonresident’s interest in property that is situated in the United States. A nonresident does not own property that is situated in the United States when owning stock of a foreign corporation that owns an entity that owns U.S. real estate:

- The asset owned by the nonresident is corporate stock, which is considered to be “located” where the corporation was formed – by definition, outside of the United States.

- We do not treat a shareholder as an owner of corporate assets, so the fact that the foreign corporation owns U.S. real estate will not cause the shareholder to be treated as the owner of that real estate.

In estate tax jargon, a nonresident-noncitizen of the United States who owns stock of a foreign corporation is treated as owning an asset situated outside the United States, therefore the gross estate, if that person dies, consists of no assets – therefore, no estate tax.

Correct Placement in the Stack

The foreign corporation must be owned by the nonresident investor directly, or through some type of disregarded entity, such as a revocable trust. Do not have any domestic entities above the foreign corporation and below the nonresident individual.

The reason for this is that you want the nonresident investor to be the owner of the foreign corporation stock – owner of an “interest in property” to use the language of the definition of “gross estate.” You do not want the nonresident investor to be treated as holding an ownership interest in a domestic entity.

Risks

Setting Up the Structure for Acquisition: None

If you are creating a structure that will acquire the U.S. real estate, then there are no particular risks in setting up and acquiring ownership of U.S. real estate in one of these structures.

Restructuring Risk: Section 7874

However, if you are fixing a problem (the existing holding structure has an estate tax risk that you want to eliminate), watch out for Internal Revenue Code Section 7874.

If the foreign corporation acquires the assets of a domestic corporation or a domestic partnership, and if other conditions are met, a bad result can occur: the foreign corporation will be classified, for U.S. tax purposes, as a domestic corporation.

Estate tax exposure continues even after insertion of a foreign corporation into the holding structure, because the nonresident-noncitizen owns stock of a (foreign) corporation that the Internal Revenue Code pretends to be a domestic corporation. Those shares are located in the United States, therefore included in the nonresident investor’s gross estate at death.

Restructuring Risk: Section 897

The other major risk to consider when restructuring to eliminate estate tax risk is the deemed sale on disposition rules of Internal Revenue Code Section 897. You may achieve the desired estate tax benefits at the cost of triggering capital gain recognition.

Restructuring to add a foreign corporation into a holding structure necessarily requires a contribution to capital in exchange for stock of the foreign corporation. Usually, Section 351 makes this a tax-free transfer. However, Section 897 says nonrecognition provisions (like Section 351) won’t work unless you find a specific exemption within Section 897 that allows it. More on this in a future episode.

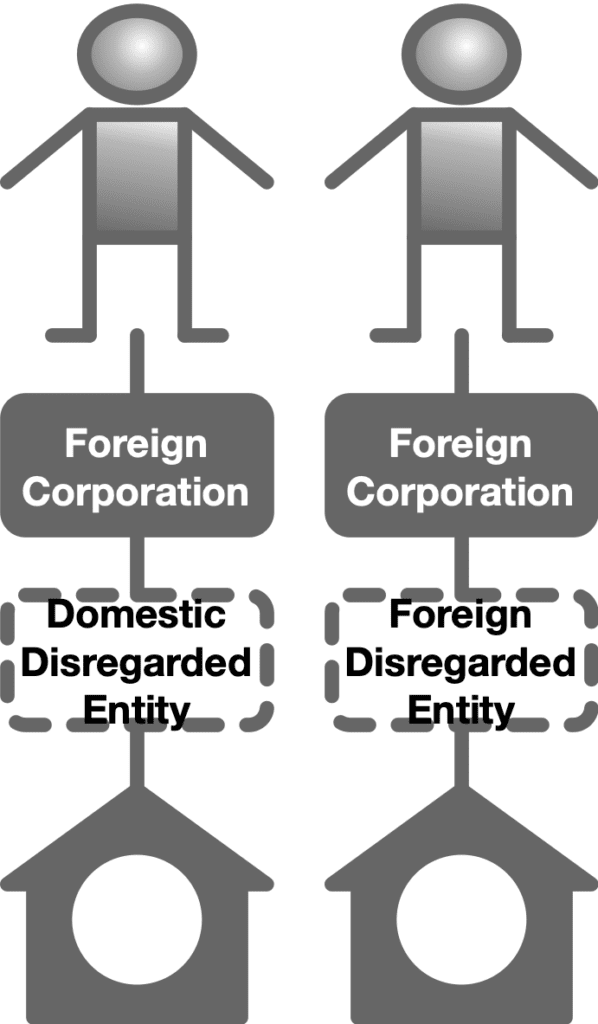

Foreign Corporation/Foreign or Domestic Disregarded Entity

In Episode 5, I noted that a foreign corporation/disregarded entity structure would provide the desired estate tax protection if the real estate is acquired in such a structure.

As for restructuring from an LLC-only to a foreign corporation/LLC structure, risks are minimized.

There is no problem with Section 7874, which only activates if a foreign corporation acquires the assets of a domestic corporation or domestic partnership, and other conditions are satisfied. Here, a foreign corporation would acquire the assets of a disregarded entity. By its terms, Section 7874 will not apply.

You will need to look at Section 897 to ensure that you can use Section 351 to create nonrecognition treatment for the transfer of membership interests of the LLC to the foreign corporation.

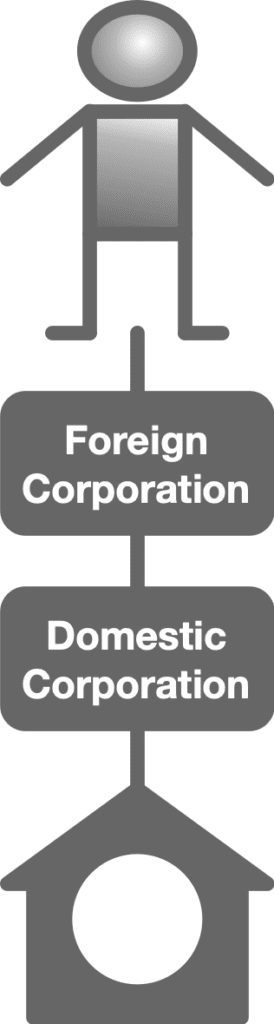

Foreign Corporation/Domestic Corporation

Acquiring U.S. real estate in a foreign parent/domestic subsidiary structure is fine. It will prevent estate tax.

However, if you are restructuring from domestic corporate ownership of U.S. real estate to a desired foreign parent/domestic subsidiary structure, Section 7874 will be a major problem for you. In normal situations that I encounter, Section 7874 causes the foreign corporation to be classified as a domestic corporation for U.S. tax purposes.

Section 897 is also a problem. Contribution of the domestic corporation stock to the foreign corporation as a capital contribution does not qualify for nonrecognition under Section 351 unless you can find an explicit approval mechanism under Section 897.

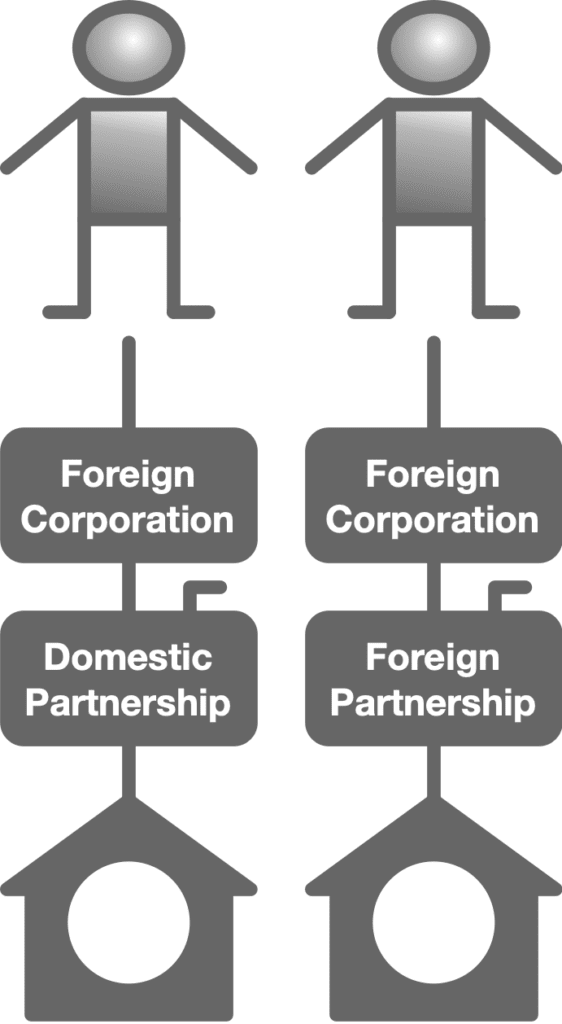

Foreign Corporation/Foreign or Domestic Partnership

A foreign corporation is a classic vehicle to hold a partnership interest in partnerships that own U.S. real estate. In tax jargon, these corporations are called “blockers”.

Conclusion

Estate tax prevention is a primary objective for nonresident investors. Structures using foreign corporations to achieve that goal are effective and leave the nonresident investor in full control of the investment.

For a personal residence that will not be rented, setting up a foreign corporation structure is a good choice. Yes, it has some income tax problems that I will talk about in a future episode. But it is (relatively) cheap compared to the alternative: a trust.

It is only when transitioning from a defective existing structure to a better structure that provides estate tax protection that you need to be wary. Watch out for gain recognition triggered by Section 897, and watch out for inadvertently transforming your foreign corporation into a domestic corporation through Section 7874.