The family attribution rules have a curious asymmetry

Hey there, all you intelligent and good-looking readers of The Friday Edition. I’m Phil Hodgen, and I’m glad you’re here.

I am working on the Category 4 Field Guide and had a TIL moment, and I’m going to share it with you: the family attribution rules of IRC Section 318(a) have a weird and unexpected (for me) asymmetry. This week, I was one of the lucky 10,000.

But first, some cool stuff

- The International Tax Pros community continues to grow. We are now over 100 accountants, enrolled agents, and attorneys. Join us. Or email me if you have questions or want to talk.

- Debra Rudd, CPA in our firm has worked on hundreds of expatriation matters. She knows IRC Section 877A backwards and forwards. Now she has posted a new video about expatriation on our YouTube channel–Why Potential Expatriates May Not Want to Roll Over a 401k. Her goals is to post one a month. Maybe you want to subscribe to see what she does next month?

- The International Tax Pros community will be having a one-day tax meet-up and conference in London (yes, THAT London) on June 27, 2025. First priority will be for members, but a limited number of tickets will be available for nonmembers. If you want to attend, email me so I can put you on the waitlist. CPE for accountants and CE for enrolled agents. More information soon.

- The International Tax Lunch on February 28, 2025 (noon Pacific time) will be the third in the foreign trust series–Foreign Nongrantor Trusts. If you are on this mailing list you will get emails telling you how to watch for free (or pay CalCPA a bit of money and get an hour of CPE credit).

The Asymmetry

Family attribution seems to be a simple idea: attribute ownership of stock up and down the bloodline, and sideways to spouses.

That’s nearly right. “Nearly right” in tax = wrong.

I am spending some quality time working on Form 5471 projects–including writing up a Field Guide for determining Category 4 filing status. The great big TIL light shined for me. All I had to do was read the Code and I would have seen it. But I read the Code and didn’t see it. Until this week.

IRC §318(a) is used for Categories 1, 4, and 5 filing status determinations, so it’s important in Form 5471 work. You need to apply it to determine a U.S. person’s stock ownership so you can check the right filing status boxes in Form 5471, Item B.

Here’s what IRC §318(a)(1)(A)(ii) says about family attribution up and down the family tree:

An individual shall be considered as owning the stock owned, directly or indirectly, by or for . . . (ii) his children, grandchildren, and parents.

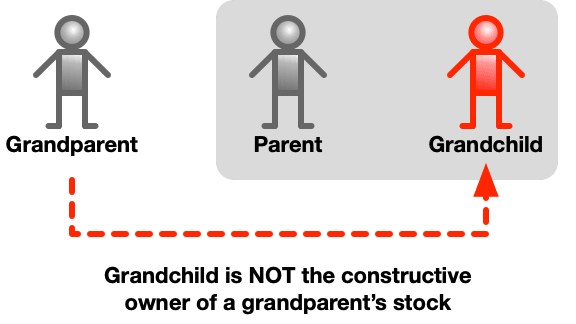

Let’s say the “individual” is Grandparent. Attribution of stock ownership is allowed from the Grandparent’s grandchild. That is what IRC §318(a)(1)(A)(ii) says.

But what about the reverse? If we read “individual” as meaning Grandchild, IRC §318(a)(1)(A)(ii) does not attribute stock ownership from grandparent to Grandchild. The word “grandparent” is not there.

It’s not like like this is a big secret . . . for those who do the reading. (Which, until this week, did not include me).

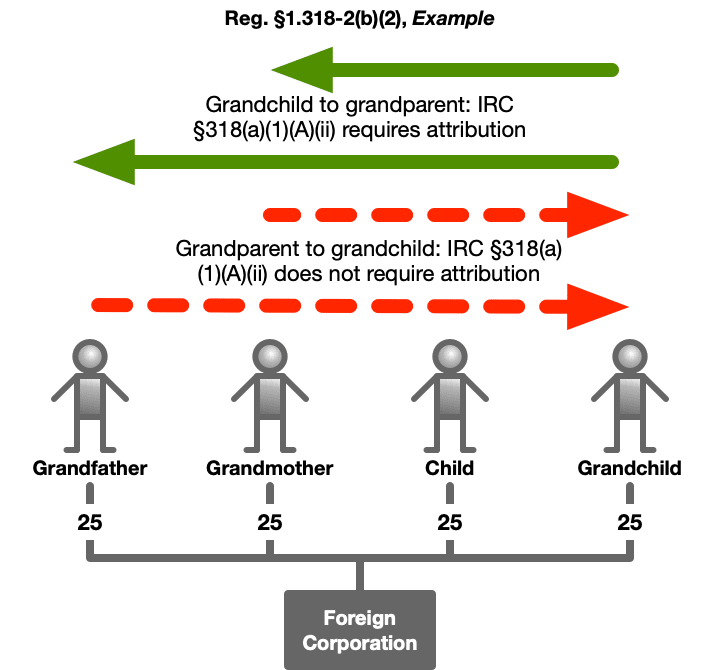

There’s even an example in the Regulations about this: Reg. §1.318-2(b)(2), Example.

An individual, H, his wife, W, his son, S, and his grandson (S’s son), G, own the 100 outstanding shares of stock of a corporation, each owning 25 shares. H, W, and S are each considered as owning 100 shares. G is considered as owning only 50 shares, that is, his own and his father’s.

H = Grandfather; W = Grandmother, S = Son (of Grandfather and Grandmother); and G = Grandson of Grandfather and Grandmother and child of Son.

Ignore attribution from Son to his parents (H and W) and to Grandchild. Here’s how the attribution rules work between Grandson and Grandparents:

The green solid arrows show attribution from Grandchild to Grandfather and Grandmother. The red dashed arrows show that attribution does not flow from Grandfather and Grandmother to Grandchild.

Weird, right?

The asymmetry is weird, right? Well, actually no. It sort of makes sense, at least in the Category 4 filing requirement situation. Remember that Category 4 is all about identifying people who have “control” of a foreign corporation.

It would be quite reasonable to assume that a grandparent might give stock to a grandchild, yet continue pulling strings behind the scenes. That’s what happens all the time in family businesses: the older generation continues to control the business even after passing ownership to younger generations.

In contrast, it would be unusual for a grandchild to be running the show at a corporation and give stock ownership to a grandparent.

In any event, the asymmetry is there.

In delving into the legislative history for this Code provision, I found that sometime in the mid-1950s there was a bit of pushing and shoving to bring full symmetry to IRC §318(a)(1)(A)(ii) by adding the word “grandparent.”. The efforts went nowhere, and seventy years later, here we are–as asymmetrical as ever.

(And yes, I am quite aware of the Twitter kerfluffle about the word “delve” as a tell for “written by AI.”)

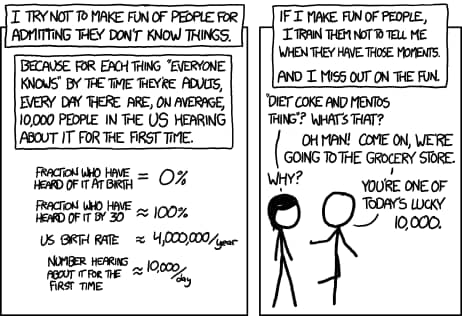

This week, I was one of the 10,000

We should all live long enough to be one of the 10,000. This week, that was me: I learned a cool little wrinkle in the Internal Revenue Code–a wrinkle blindingly obvious to everyone else. Obligatory XKCD (1053):

That’s it for now. Please forward this to a friend so your friend can subscribe. And thanks for being here and reading my newsletter. This is fun.

Phil.